Revenue Saving in 2025: Top Apps for Quick Wins on Emergency Funds

A surprise bill can turn your budget upside down. For lots of people, a single unexpected cost means playing catch-up for weeks. Saving for these moments seems like a luxury for when you have extra cash. What if your phone could handle some of that work for you, starting today?

These tools don’t need you to become a finance expert overnight. They each plug a different kind of money leak or just save for you automatically. We’ll go through a few that get you noticeable results, no complicated advice needed.

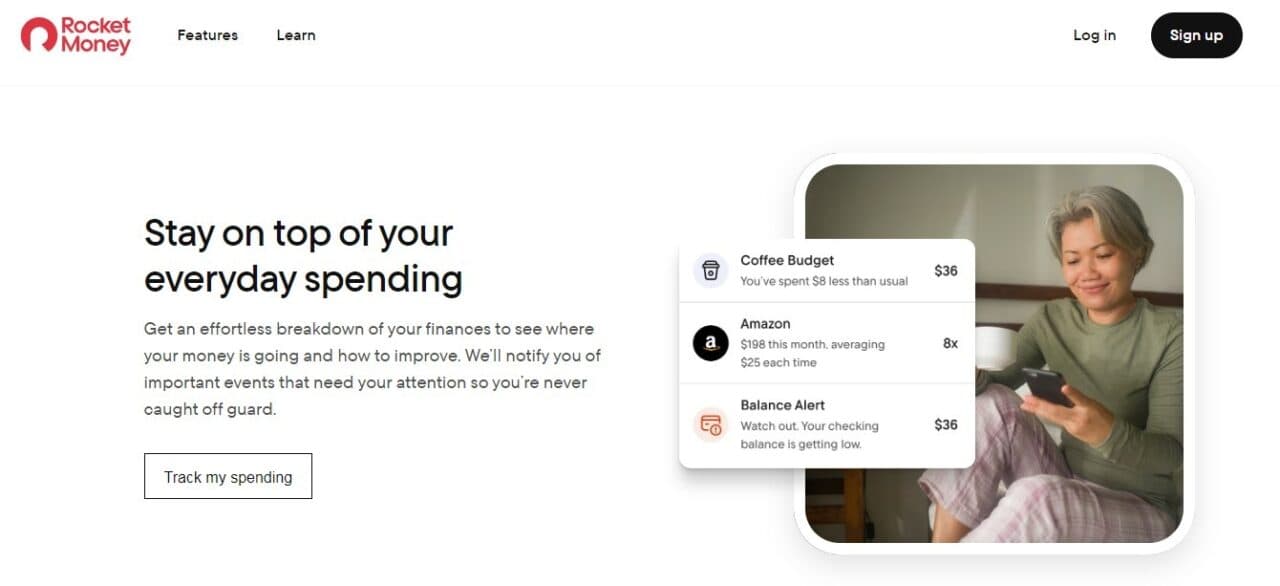

Rocket Money: The Subscription Slayer

Your monthly subscriptions are likely siphoning off more money than you realize. Rocket Money digs into your connected accounts and hunts down these recurring charges. It presents them in a clear list, showing you everything from your streaming services to forgotten app memberships.

Its best trick might be the cancellation help. You can tell Rocket Money to cancel subscriptions on your behalf. It deals with the customer service steps for you. Killing one unused $15 monthly charge puts that money back in your account. That’s an instant cash boost you can move directly into your savings jar.

Acorns: The Spare Change Engine

Manually moving small amounts into savings is a chore most people skip. Acorns removes the decision entirely. It links to your debit or credit cards and rounds up each transaction to the nearest dollar. That spare change from your $4.50 coffee or your $23.80 grocery run gets invested automatically.

These micro-investments are pulled from your checking account and placed into a diversified portfolio. You won’t get rich on round-ups alone, but the consistent, automated action builds a surprising sum over time. It’s a set-and-forget method for growing a fund you can access when needed, turning your everyday spending into a silent saving habit.

Chime: The Seamless Banking Buffer

Chime works as a mobile bank that fights fee drain. Its SpotMe feature is the main attraction. It fronts the money if you accidentally overspend with your debit card. A small purchase won’t spiral into a giant overdraft charge. This protects the savings you’ve managed to build.

Beyond protection, Chime helps you build. You can automatically transfer a percentage of every paycheck directly into your savings. Their “round-up” feature also saves your spare change from Chime card purchases. It combines defense against fees with simple, automatic offense for your savings goals.

Qapital: The Rule-Based Saver

If you want savings to feel like a game, Qapital delivers. You create personalized “rules” that trigger automatic transfers. You can save the round-up from every purchase, set aside $5 every time you post on social media, or save a specific amount on a sunny day.

Qapital links to your bank and runs your rules on its own. You save tiny bits of cash based on things you do anyway. It never feels like a harsh money diet. This turns a vague savings goal into something that happens automatically. Your fund grows with cash you probably would have spent without a thought.

Finelo: The Confidence Builder

While other apps handle the mechanics of saving, Finelo.com tackles the knowledge gap. It’s the “why” behind the “what.” The platform uses short, interactive lessons to explain why an emergency fund is your first line of defense against debt. It breaks down how much to save and where to keep it.

Their financial simulator lets you test scenarios, like seeing the impact of a sudden $1,000 expense with and without a safety net. This builds the conviction needed to stick with your savings plan. Finelo.com provides the foundational knowledge that makes using the other tools feel more purposeful and sustainable.

Oportun: The Savings Algorithm

Oportun used to be called Digit. It works like a robot for your savings. Connect your main bank account, and its math starts reviewing your paychecks, bills, and spending.

It figures out your personal money rhythm. Then it finds a few spare dollars here and there that are safe to move. These small shifts from checking to savings won’t leave you short. These transfers happen automatically every few days.

The result is a growing emergency fund built with money you likely never noticed was available, making the process of saving completely effortless.

Mint: The Financial Dashboard

Mint acts like a mission control for everything you own and owe. Link your bank accounts, cards, and bills. It pulls all your money moves into one simple screen. One look shows your cash, your debts, and what you owe soon.

The app automatically files each purchase. You see “Food,” “Shopping,” and “Bills” without typing a thing. This shows your spending patterns clearly. That full picture helps you build a savings plan. You can spot waste and redirect those dollars toward your emergency fund.

Picking Your Financial Fix

What’s your money style? Do you make a budget only to ignore it completely a few days later? Does it bug you to see cash disappear for services you never open? Or does the whole process feel confusing, making you put it off entirely?

These apps are built for those specific frustrations. They each tackle a different financial pain point. The key is to identify your biggest source of money stress right now. Is it mysterious monthly charges? The inability to save consistently? A general feeling of being disorganized?

Choosing the tool that addresses your main headache makes the process feel less like a chore. Any forward movement, no matter how small, starts building that essential buffer between you and an unexpected bill.

Conclusion

Use the method you won’t quit after a week. Maybe you spend five minutes with Rocket Money to grab back $30 from old subscriptions. Perhaps you enjoy seeing Acorns stack your loose change into something bigger. Or you just want Chime to block a nasty overdraft fee.

Your job is to do one small thing now.

Choose the tool that fixes your biggest money annoyance. The best pick feels helpful, not like more homework. It makes your finances slightly simpler and much less shaky. That single step, no matter how tiny, begins your safety net.